Private Limited Company in India

How to Register a Private Limited Company in India

Starting your own business is exciting—but it can also feel overwhelming, especially when it comes to legal registrations. If you’re planning to kick off your startup or small venture in India, one of the best ways to give it a proper legal identity is by registering it as a Private Limited Company.

So, What Exactly Is a Private Limited Company?

A Private Limited Company is a business entity registered under the Companies Act, 2013. It has a separate legal identity from its owners, which means the business and the individuals behind it are not one and the same.

In simpler words, the company can:

Own property

Own property

Borrow money

And sign contracts

To set one up, you need at least two directors and two shareholders. One director must be a resident of India. The maximum number of shareholders allowed is 200.

Why Do So Many People Choose This Business Structure?

Here’s why a Pvt Ltd company is one of the top picks for startups and growing businesses:

Limited liability

If the company runs into losses, your personal assets are safe. You’re only responsible for what you’ve invested.

Separate legal existence

The business continues

even if the ownership changes.

Better funding options

Banks and investors take

Pvt Ltd firms more seriously.

Brand image

Clients and suppliers feel more confident

dealing with a registered business.

Easy ownership transfer

You can transfer shares

(though with some restrictions).

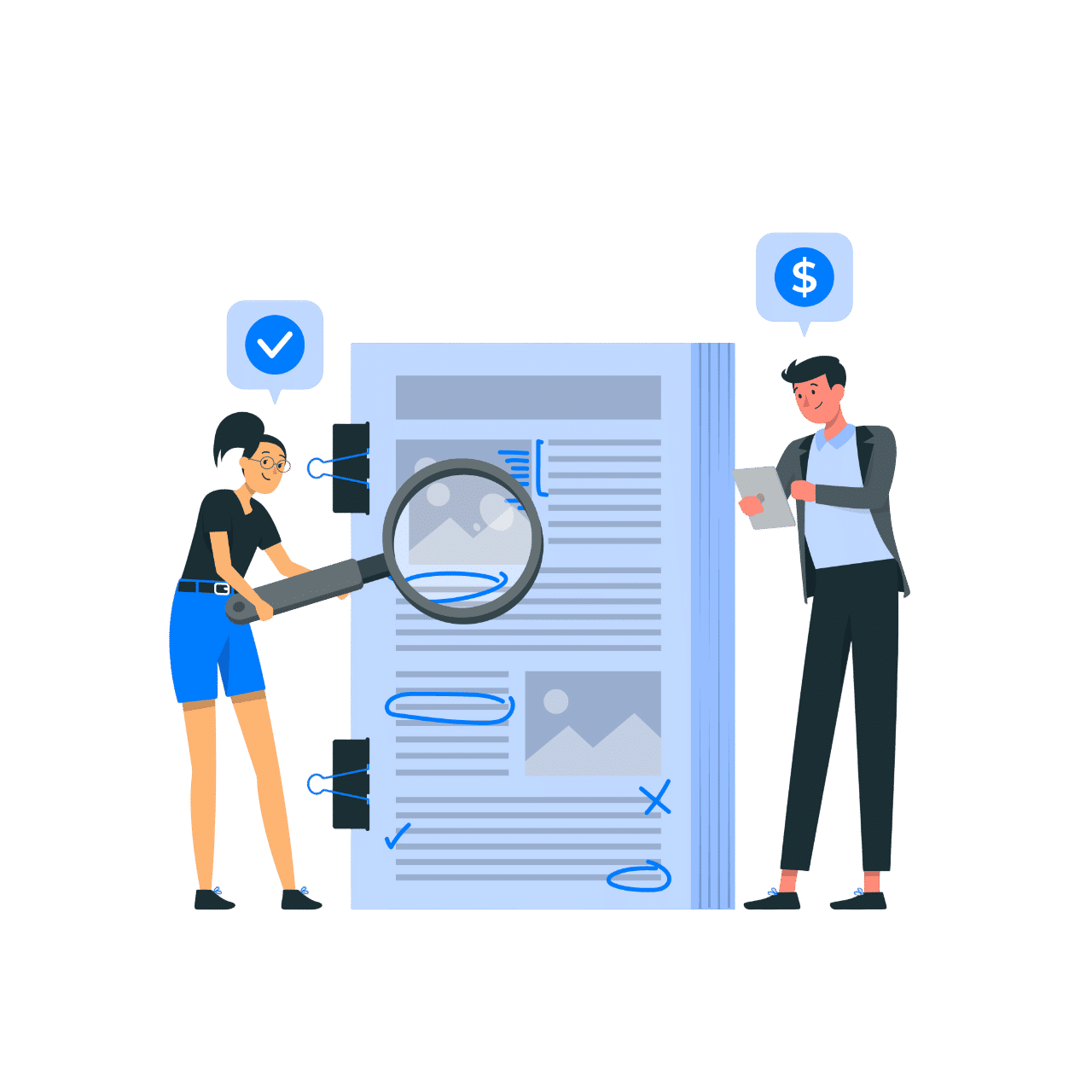

Step-by-Step: How to Register Your Private Limited Company in India

Let’s walk through the actual registration process. Most of it can be done online now, thanks to the MCA (Ministry of Corporate Affairs) portal.

Step 1: Get Your Digital Signatures (DSC)

The directors need something called a Digital Signature Certificate (DSC). It’s just a secure way of signing electronic documents. Think of it as your digital thumbprint.

Step 2: Apply for Director Identification Number (DIN)

Next, you’ll need a DIN for every director. This is done through the SPICe+ form, which is the government’s combo-form for company registration.

Step 3: Choose a Name

Pick a unique name and get it approved through the RUN (Reserve Unique Name) service. Make sure it doesn’t clash with any existing company or trademark.

Step 4: Submit Incorporation Documents

Once the name is locked in, you need to upload the key documents like:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Proof of address for the registered office

- ID and address proof of all directors

All of this goes through the SPICe+ form, which includes tax registration and EPFO/ESIC as well.

Step 5: Get PAN & TAN

These are issued along with the Certificate of Incorporation. No need for separate applications.

Step 6: Receive Certificate of Incorporation

Once approved, you’ll get a soft copy of your COI. That’s your official proof of company existence!

Documents You’ll Need

Here’s a simple list to prepare before you apply

For Directors/Shareholders:

- PAN Card

- Aadhaar card or Voter ID

- Passport-sized photo

- Bank statement or utility bill (for address proof)

For the Office Address

- Rent agreement (if rented)

- NOC from landlord

- Latest electricity or gas bill

Costs Involved (Rough Estimate)

Here’s what you’re likely to spend

Expense Item | Estimated Cost |

Digital Signatures (DSC) | ₹1,000 to ₹1,500 per person |

Name Approval | ₹1,000 |

Government Fees | ₹2,000 – ₹6,000 |

Professional Help (optional) | ₹5,000 – ₹10,000 |

Total | ₹8,000 – ₹20,000 |

After Registration: What’s Next

People often think registration is the end, but it’s really just the beginning. Once your company is live, you need to take care of some basics:

Appoint an auditor (within 30 days)

Open a current bank account

File income tax returns annually

Conduct board meetings

Maintain proper records (this part is often ignored!)

File annual returns with the ROC

Common Pitfalls to Avoid

Here are some things that can delay or derail your registration:

- Choosing a name that’s already taken (always double-check with MCA and trademark sites)

- Uploading incorrect or mismatched documents

- Not following up after incorporation (especially with post-registration compliance)